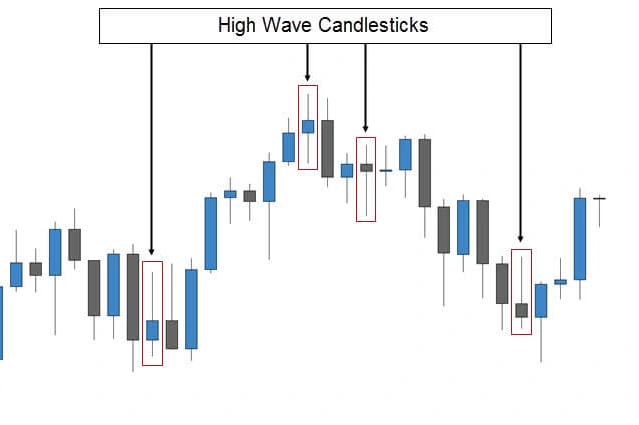

The high wave candlestick pattern is a basic pattern that indicates that neither has one or two long shadows and knows bullish and bearish market conditions.

This market candlestick pattern prices are not the same. It contains the differences from each other. The conditions of candlesticks will calculate with the long-legged Doji. In a specific direction, the bears and bulls compete with the price.

The design of the candlestick will show as long lower shadows and long higher wicks, and it contains the little bodies. Throughout the period, the price movement will indicate as long wicks. Eventually, near the opening level, the price will settle.

Sometimes, the buyer's and seller's attempts will be as intense. The buyer attempted to raise the price level but faced extreme opposition. Likewise, the seller tried to cut prices but saw a fierce opponent. Both fall pushes the price on a specific path, resulting in the candlestick closing near where it started.

Basic High-Wave Candlestick Pattern.

It looks similar to the Doji candlestick pattern. It's unimportant to get captured in the trivia of reading the same state of candlesticks because of the parallels in delayed candles. The story of the high wave candlestick will tell it as delayed.

The high wave candlesticks pattern tells the story of the market difficulties and stock value in the form of the real body with long shadows from the top and bottom. It contains the bears and bulls candle form that will confuse the stocks' value and volume. Traders confuse the stock value base on this. Execute the tools and know the trading techniques and their importance of them.

High Wave Pattern Identification for Traders

Before starting, buyers and sellers will understand traders' market value and volume. High wave patterns indicate the conditions of the market difficulties and stock values. Having a clear understanding of the market's demand, the details of supply and need are exact. Later, it forms the high volume and shows the common confusion in the market and prices.

Candlestick forms in diverse places on charts - Consolidating markets.

- It uses the spinning top, Doji, and high ave candlesticks, in the form of downtrend and uptrend.

- Bearish and bullish bodies are in high wave candlestick patterns and spinning tops.

- Comparison of the high wave real body is more significant than the spinning top real body.

- It indicates the possible direction ways.

- It shows the possibility of information to the traders and reverses signals arriving.

- The real body and long shadows will help know much volatility with the indecision.

- It reflects the market value and the difficult time of reaching a consensus.

Knowing the Trade of High Wave Candlesticks

- Traders bear a long time when the price breaks on the high candlesticks.

- At the low stop level, use the candlesticks close below.

- A short break of the low and utilizing the candlestick close overhead high as a stop.

- Before placing a trade, see the chart form, wait for a day, and get confirmation of where the stock will run.

- With the patient, notice the value and movement of candlesticks on the right deal.

- Most essential to follow the candlesticks and it's directions of the stock head.

- So important points in candlesticks are patience and the value of the patterns that come to you.

With the massive practice and study of high wave candlesticks patterns, the value of the trade on the market with patience will take vital signals.